The truth of the matter is that it is simply too early to be able to determine what impact this pandemic will have on not just the Orthopaedic industry, but the overall Medical Device sector. The short answer; There will be a temporary economic downturn, followed by a boom. Long term however, it is likely that there will be some permanent, fundamental changes to how Medtech companies operate and deliver value to their customers.

Any medical procedure that can be deferred until after this passes will be, that means reduced procedure volumes for hospitals which directly hits medical device companies’ bottom lines. One speciality that stands to be impacted more than most is the commercial Orthopaedic sector.

Canaccord Genuity (An American Investment and consultancy business) analyst Kyle Rose surveyed orthopaedic/spine surgeons to assess the impact on treatment patterns and practice viability. As expected, most of the 50 respondents (60%) said their organisations were deferring or postponing all procedures, and about a third of respondents indicated that 90% of their entire practice is deferrable. On average, the survey suggests a 58% decline in patient volumes in March and an anticipated 77% average decline in April, Rose noted in his report. I am hearing that many surgeons across Australia are having to reduce their own costs, given many have seen a reduction in income from anywhere between 70-90%. This means “laying off” or at the very least furloughing staff until such time as things start to improve.

The obvious impact of this reduction in procedure volume, particularly for pure Orthopaedic companies, isn’t too difficult to quantify. This hit on revenue can and will have a drastic impact on the people that work for these companies. It has been unfortunate to hear of some of the measures that Ortho companies here in AN/Z are having to put in place in order to weather this storm. Reduced working hours & enforced leave are the rule & not the exception and for many, discussions around redundancies are a reality that cannot be ignored. This will be a trend that remains in place and become increasingly common the longer this pandemic lasts.

Despite these near-term impacts, Rose expects to see a sharp acceleration in volumes in the back half of the year after the COVID-19 uncertainty moderates. Many of his survey respondents (41%) said they plan to “catch up” on procedure volumes within three months and another 35% within six months. The general feeling amongst leaders I have spoken to within the industry here is that upturn in volume is inevitable, we just don’t know at this stage when that will be.

The annual plans that MedTech companies set out in January will no undoubtedly look very different. No Orthopaedic business will have prepared for an indefinite pause on elective surgery, the companies that are best positioned to weather this economic dip are those who have a diversified product portfolio, whose customers are typically large trauma centres and those who have cash in the bank. For big, public companies, this may present a double hit, a downturn in sales represents a dip in the share price. It is likely that we will see volumes dip in Q3 and possibly Q4, with some analysts predicting between 4-18% impact on sales, although I would imagine that this number will be a lot higher.

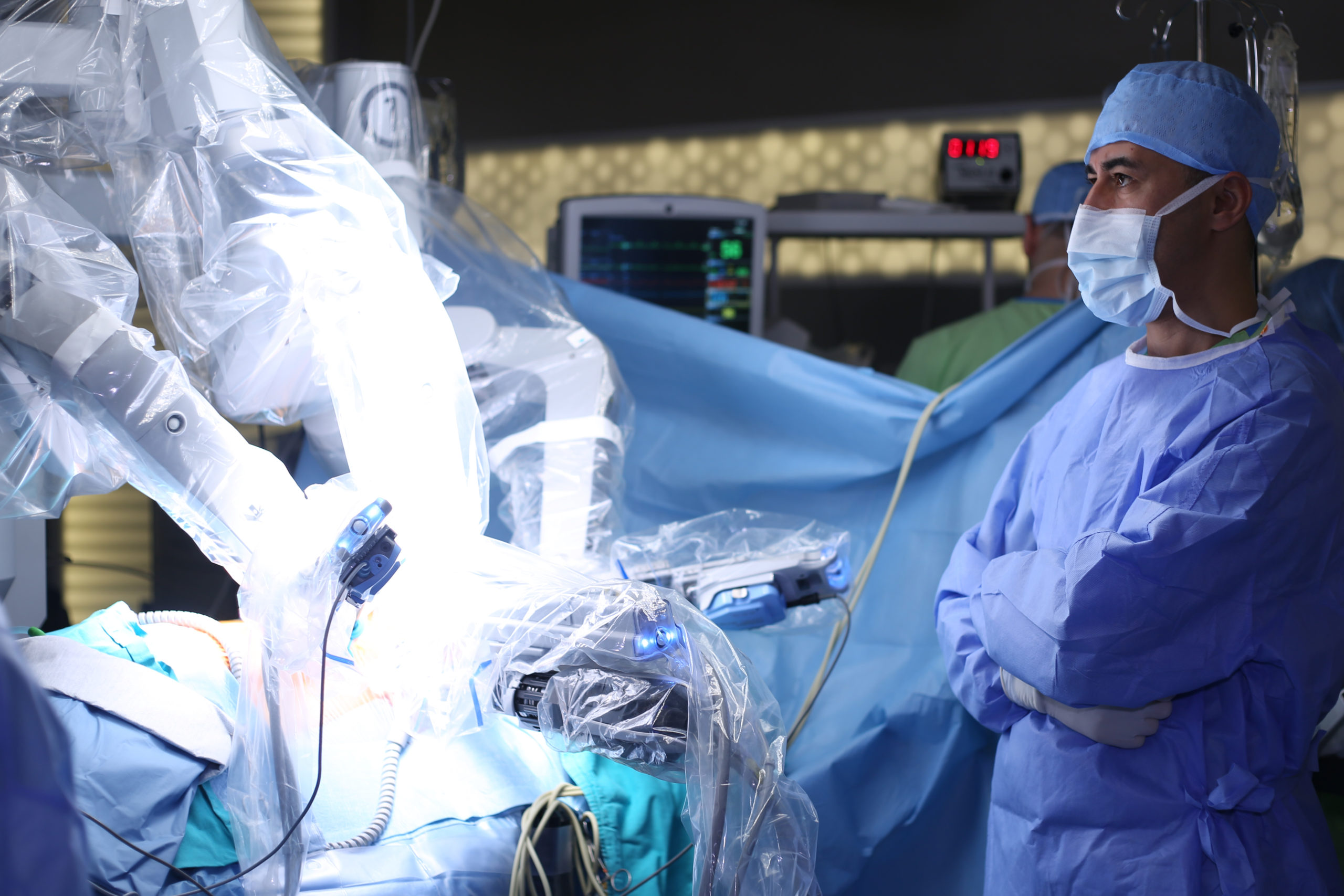

Robotics has been a big focus in Orthopaedic’s and revenue source for companies like Stryker, which saw Mako procedures jump nearly 50% in the fourth quarter last year, bringing the full year 2019 total north of 114,000. Fortunately for Stryker, the company is fairly diverse and draws a decent amount of revenue from trauma procedures, which shouldn’t be impacted by COVID-19. The pandemic could, however, affect the closing timeline for Stryker’s $4 billion acquisition of Wright Medical, announced last November, although time will tell. Zimmer Biomet has also seen notable success in robotics with its ROSA Total Knee robotic system. In fact, ZB CEO Bryan Hanson said in January that the company’s funnel for ROSA placements was the strongest it had ever been and the surgical robotic system was expected to be a key growth driver for ZB in 2020. I would not be surprised to see a significant decline in capital purchases, which would include robotics, given the cash flow constraints of hospital customers.

Whilst tens of thousands of Orthopaedic industry professionals will work from home for the first time, I know that most Ortho companies are using this time to develop and where possible improve the skill set of their reps. Many reps are now embarking on “re-certification” programmes to ensure they are better and more clinically equipped coming out of the back of this than they were going in. One of the biggest impacts on the industry will be with the way Ortho companies conduct business. We are all learning to social distance, we will work remotely for some period, there will be few face to face meetings. Large meetings and Ortho conferences will be postponed or cancelled. Ortho companies will need to think about how they can continue to engage and connect with their customers during this time.

The hiring market across Orthopaedics right now is naturally very quiet. However, growing Orthopaedic companies still need talent, whilst we will see a downturn in recruitment activity, hiring will continue in pockets but there will be a general trend towards more video based interviews. Now is truly the BEST TIME IN HISTORY to speak with new talent. Proactive companies are getting prepared for the coming, likely Q3 boom. Managers have a captive audience, remote interviewing is easy and efficient & people have the time. Some companies I know are taking people through the process ready to offer when the tide starts to turn.

Many people are asking themselves, when will we see elective cases start again. Ortho company leaders are all trying to figure out when the backlog of procedures will be released. Will this be weeks or more likely, months? No one can say for sure, once we have passed the ICU peak usage for the virus, we should have a better idea. One thing I can be certain of, there is going to be a HUGE backlog of elective procedures lined up. There will be significant opportunity at the back end of this for some device companies, the smart ones will be well positioned to take advantage and take market share.

In many ways, this pandemic may make ortho companies become healthier. More meetings will be conducted over video or audio calls, employees will learn to work effectively from anywhere, ortho sales and service will learn to better service hospitals in a more streamlined way, virtual reality training will get a boost. We may see certain hospitals learn to support cases without the sales rep attendance and many may permanently ban reps. The way companies drive growth and how they engage with their customers will change, maybe for the better.

Amongst all the uncertainties, one thing is for certain. This is temporary, it wont last. There will be a boom, and when it comes, make sure you ask yourself, are you a better person coming off the back of this than you were going in? Make sure your answer to that question is YES

Kim Jones

OneMD